Government Pension Plans

"We’re beyond crisis," Katy Durant, chair of the Oregon Investment Council, said in an interview after last week’s meeting. "We should have been addressing this 20 years ago and it’s just been building. It’s a little bit like a Ponzi scheme. Sooner or later it’s going to catch up with you."

For the past century, a public pension was an ironclad promise. Whatever else happened, retired policemen and firefighters and teachers would be paid.

That is no longer the case.

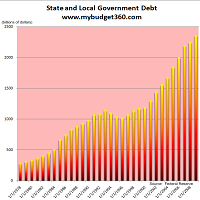

Many cities and states can no longer afford the unsustainable retirement promises made to millions of public workers over many years. By one estimate they are short $5 trillion, an amount that is roughly equal to the output of the world’s third-largest economy.

-Sarah Krouse

Just how bad is Oregon’s public pension funding crisis? Bad enough that Rukaiyah Adams, the normally polished investment professional who is vice chair of the Oregon Investment Council, broke down in tears last week as she spoke of passing a record $22 billion in unfunded promises to future taxpayers. -Ted Sickinger

“We’re beyond crisis,” Katy Durant, chair of the Oregon Investment Council, said in an interview after last week’s meeting. “We should have been addressing this 20 years ago and it’s just been building. It’s a little bit like a Ponzi scheme. Sooner or later it’s going to catch up with you.” -Ted Sickinger

Government, Incompetence, Financial, Oops

It turns out that Calpers, which managed the little pension plan, keeps two sets of books: the officially stated numbers, and another set that reflects the “market value” of the pensions that people have earned. The second number is not publicly disclosed. And it typically paints a much more troubling picture, according to people who follow the money...

But more important, it raises serious concerns that governments nationwide do not know the true condition of the pension funds they are responsible for. That exposes millions of people, including retired public workers, local taxpayers and municipal bond buyers — who are often retirees themselves — to risks they have no way of knowing about.

Government, Incompetence, Financial, Oops, Debt

A federal bankruptcy judge dealt a serious blow to California's public employee pension systems by ruling Wednesday that payments for future worker retirements can be reduced when a city declares bankruptcy -- just like its other debts. U.S. Bankruptcy Judge Christopher Klein ruled that bankruptcy law supersedes California pension laws that require cities to fund their workers' future retirement checks. "I've concluded the pension could be adjusted,” Klein said.

Government, Incompetence, Financial

The federal government’s backstop for troubled pension funds is facing a record-setting deficit, increasing the likelihood of a taxpayer-funded bailout. The Pension Benefit Guaranty Corporation (PBGC), which terminates and takes over retirement systems for struggling companies, ran up a $34 billion deficit as of Sept. 30, 2012. That figure is triple the $11 billion deficit the agency had at the end of the Bush administration and its $26 billion deficit 2011.

Editorial, Government, Incompetence, Financial, Oops, Greed

The Kentucky Public Employee Pension System is a bankrupt promise that the state legislature cannot keep. Taxpayers should be furious that lawmakers – through greed, mismanagement and inaction – have allowed this system to deteriorate. State employees should be equally as angry at the prospect that they may never collect the pensions they have been promised.

Oregon’s pension fund for public employees is now in a $16 billion hole caused by the failure of its investments to come anywhere close to the 8 percent rate of return the state was predicting. Now lawmakers are forced to choose between contributing billions of taxpayer dollars to close the pension gap or fully funding the state’s school system.

Union, Government, Incompetence, Financial, Debt

The city filed for bankruptcy protection on Wednesday, citing over $1 billion in estimated liabilities and up to 25,000 creditors, many of whom are the city's own employees. The city, 65 miles east of Los Angeles, also listed estimated assets as over $1 billion. Patrick J. Morris, San Bernardino's mayor, said in a telephone interview that the bulk of the city's debt was due to "unfunded liabilities related to pension and benefits" for the city's employees, and "obligations to employee groups in labor contracts."

Democrat, Liberal, Incompetence, Obama, Financial, Debt

(Reuters) - The Treasury on Tuesday started dipping into federal pension funds in order to give the Obama administration more credit to pay government bills. "I will be unable to invest fully" the federal employees retirement system fund beginning Tuesday, Treasury Secretary Timothy Geithner said in a letter to Democratic and Republican leaders in Congress.

Liberal, Financial

As of July 2011, 12,199 retired California employees draw six-figure pensions, according to the watchdog group, California Foundation for Fiscal Reform (CFFR), up from 9,111 in March of last year. Three of the new six-figure pensions provide the retired recipients with more than $260,000 annually, with the most generous of the three worth $271,157 per year, according to CFFR. RffaHF7CYZeC

Union, Government, Education, Greed, Waste

SPRINGFIELD Two lobbyists with no prior teaching experience were allowed to count their years as union employees toward a state teacher pension once they served a single day of subbing in 2007, a Tribune/WGN-TV investigation has found. Over the course of their lifetimes, both men stand to receive more than a million dollars each from a state pension fund that has less than half of the assets it needs to cover promises made to tens of thousands of public school teachers.

If you are a current or former state employee in the state of Minnesota, watch out. Your pension depends on hot air, sketchy arithmetic, and the willingness of future taxpayers to make huge sacrifices to cover the deceit, wishful thinking and sketchy math at the heart of your pension system.

Hypocrisy, Liberal, Crime, Union, Greed, Corruption

Most city workers spend decades in public service to build up modest pensions. But for former labor leader Dennis Gannon, the keys to securing a public pension were one day on the city payroll and some help from the Daley administration. And his city pension is more than modest. It's the highest of any retired union leader: $158,000. That's roughly five times greater than what the typical retired city worker receives.

Hypocrisy, Union

All it took to give nearly two dozen labor leaders from Chicago a windfall worth millions was a few tweaks to a handful of sentences in the state's lengthy pension code. Twenty years later, 23 retired union officials from Chicago stand to collect about $56 million from two ailing city pension funds thanks to the changes, a Tribune/WGN-TV investigation found.

Liberal, Incompetence, Financial

Rhode Island is one of the bluest states in the country, and one where public sector unions have long worked with sympathetic politicians to create a true blue system of well paid public employees retiring comfortably on generous pensions with cost of living raises automatically thrown in. The only problem is that the state could never afford the beautiful utopia it was crafting, and so politicians and union leaders chose the path of systemic deceit. Taxpayers weren’t told what the bill for the system would be; public service workers weren’t told that the pension guarantees they’d been sold were worthless because taxpayers would not and could not foot the bill.

Incompetence, Obama, Financial, Debt

The Obama administration will begin to tap federal retiree programs to help fund operations after the government lost its ability Monday to borrow more money from the public, adding urgency to efforts in Washington to fashion a compromise over the debt.

All it took to give nearly two dozen labor leaders from Chicago a windfall worth millions was a few tweaks to a handful of sentences in the state's lengthy pension code. Twenty years later, 23 retired union officials from Chicago stand to collect about $56 million from two ailing city pension funds thanks to the changes, a Tribune/WGN-TV investigation found.

Government, Incompetence, Financial, Education

SACRAMENTO, Calif. (AP) — The pension system for California’s teachers has $56 billion less than it needs to cover the benefits promised to its 852,000 members and their families, the fund reported Thursday, as big investment losses in 2008 continue to reverberate. RffaHF7CYZeC

Government, Incompetence, Financial

The Central Intelligence Agency Retirement and Disability System could go bankrupt by the end of 2012 without an appropriation of $513.7 million, according to a request in the 2012 federal budget.

“Independent actuarial projections show the CIARDS fund going bankrupt by the end of 2012 with an unfunded liability of $6.4 billion,” according to the funding request.

Government, Incompetence, Financial, Scandal

Prior research by the Kellogg School of Management has found $3 trillion in unfunded legacy liabilities from state-sponsored pension plans. However, new research finds additional liabilities from municipalities that magnify the growing public pension crisis. In a new report issued today by the Kellogg School, economists estimate an additional $574 billion in unfunded liabilities from pension plans at the city and county levels. The paper, “The Crisis in Local Government Pensions in the United States,” is co-authored by Joshua Rauh of the Kellogg School and Robert Novy-Marx of the University of Rochester.

Government, Financial, Fraud, Corruption

A former top political consultant to New York's disgraced ex-comptroller was led off to jail Thursday after a judge sentenced him to at least a year and four months in prison for his pivotal role in an influence-peddling scandal involving the state pension fund.

Morris, who rose to political prominence in the state as a campaign manager for Democrats, has agreed to forfeit his millions of dollars in fees.